A series of recent high-profile principal defaults and missed coupon payments highlight the uncertainties and challenges facing investors in China’s young but rapidly growing bond market. Three key areas for investors to monitor include: how authorities handle bond defaults and missed coupon payments, the standardization of bond covenants in both onshore and offshore bond indentures, and more reliable bond ratings. These developments will influence investor appetite for Chinese bonds.

First, China’s bond market needs a more predictable default mechanism and resolution process. When a bond issuer is unable to repay its obligations, a transparent reorganization or liquidation of assets is critical to ensure that market participants will willingly access (and support) the bond market again in the future. A recent set of “guiding opinions” issued by China’s regulators discusses the opening-up, reform, and development of the bond market and should be considered a meaningful step forward. In this case, the guiding opinion covers a range of issues: restricting bond sales by highly leveraged companies, prohibiting companies from buying their own bonds, promoting convergence of the interbank bond market and the exchange traded bond market in terms of standards to strengthen supervision and law enforcement, and improving oversight of credit ratings agencies. The strengthening of supervision and legal enforcement should make the default process in China more predictable and have a meaningful positive impact on investor sentiment.

The guidelines aim to unify the rules for China’s different bond market venues, strengthen oversight and law enforcement, and clarify which securities laws and regulations are applicable, with an emphasis on their consistent application to all borrowers. The release of these guidelines is evidence that Chinese regulators understand the need for better functioning bond markets and is a step in the right direction. If the Chinese authorities are serious about increasing foreign ownership of the onshore bond market, the consistent application of predictable default mechanisms to all borrowers would be a good starting point.

Second, China needs improved and standardized bond covenants. One of the largest problems with the Chinese bond market is the variable treatment of creditors. Equal treatment of creditors is typically ensured through cross-default provisions in indentures, but cross-default provisions in the Chinese bond market sometimes function differently than in international bond markets. The triggers for a cross default can be less robust in China, and this allows for bilateral creditor negotiations and out-of-court resolutions rather than transparent and comprehensive restructurings with all creditors fairly represented in the process. Other features typical in international bond indentures – such as negative pledge, change of control, limitations on indebtedness, and restricted payments – tend to be weak or non-existent in Chinese bond indentures. Bond investors like clarity, especially the type of clarity offered by standardized and uniformly enforced bond covenants.

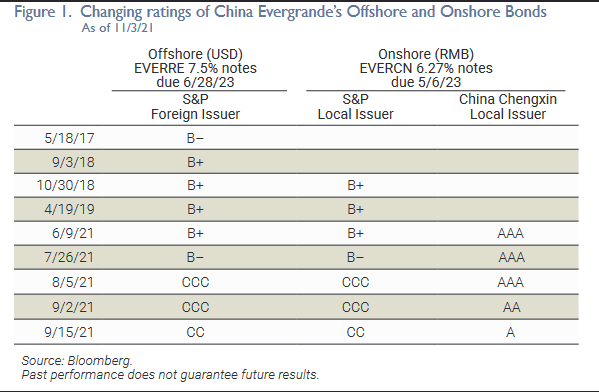

Lastly, China needs more reliable and more transparent bond ratings. One only need look at bond ratings of Evergrande, China’s most heavily indebted and financially troubled property developer, to see that the local rating agencies are not contributing much to the healthy maturation of this market. As an example, Figure 1 shows the ratings evolution of Evergrande’s USD-denominated offshore bonds and RMB-denominated onshore bonds. As of November 3, China’s Chengxin rating agency still had a local issuer rating of single A for Evergrande despite a preponderance of evidence that a restructuring is highly probable. China’s bond market could benefit from a larger presence of foreign bond rating agencies; in this instance, foreign rating agencies have painted a clearer picture of the situation for investors.

Financial stability continues to be a top policy priority in China. More transparent defaults, more standardized covenants in bond indentures and better ratings are needed for stability in China’s bond markets and the broader financial system. We are watching China’s capital markets evolve before our eyes; what happens with a few large looming defaults and restructurings will be critical to this effort.