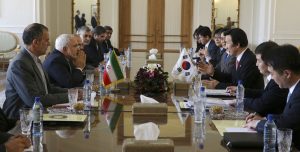

Ever since the reimposition of sanctions by the Trump administration, Iran-South Korea relations have been on a downward trajectory. Tehran has been complaining about the freezing of an estimated $7 billion in Iranian funds held in two South Korean banks since September 2019, when a U.S. waiver for imports of Iranian oil expired. A number of official meetings have been held to no avail, and that Tehran is now threatening Seoul with legal action in the International Court of Justice, a blanket trade ban on Korean goods, and the barring of Korean businesses from its lucrative construction and energy markets in the future.

For its part, Seoul has maintained that it is simply complying with the U.S. sanctions. It has also summoned the Iranian ambassador to lodge an official protest against Tehran’s threat of legal action. The unapologetic stance of South Korean officials over the past 10 months in spite of the two countries’ traditionally cordial ties, in turn, could indicate a principled change in Seoul’s conduct of resource and trade diplomacy in the Middle East.

Surely, part of Seoul’s intransigence has to do with the importance it attaches to its own commercial, political, and security ties with the United States. As a small and export-oriented nation, South Korea not only has an economic interest in maintaining its access to the U.S. market, but it is also dependent on U.S. security assistance and support for safeguarding its own national security; a dependency that is set to increase even further due to the reemergence of great power rivalries. To this end, Seoul has traditionally followed the United States’ footsteps in its conduct of foreign affairs both within and outside its immediate neighborhood. In the Middle East, this is clearly evident in South Korea’s formation of strong strategic ties with the United States’ GCC allies, especially the United Arab Emirates, as well as its full, if at times reluctant, compliance with Washington’s sanctions on Iran.

Moreover, Iranian analysts have routinely pointed to Tehran’s ties with Pyongyang as a formidable obstacle to the country’s diplomatic efforts at elevating its relations with Seoul. In particular, Iran’s offer of an energy lifeline to the Kim regime has been a constant irritation that officials in Seoul have had to put up with.

Iran’s international isolation, its lack of options, and the paucity of Seoul’s assets in Iran are also equally plausible factors behind South Korea’s uncompromising stance. Taking the legal route to recover Iranian assets will be a cumbersome process that could drag on for years and hence it is a non-starter for a country that is in dire need of capital now. Moreover, South Korean businesses have next to zero assets in Iran for Tehran to expropriate. Even if they had assets, seizing them would only backfire and increase Iran’s isolation, as would any harassment of South Korean vessels passing through the Strait of Hormuz; an idea that is being touted by some local analysts.

Still, Seoul’s outright refusal to give in to the Iranian pressure stands in sharp contrast to its more compromising stance on sanction enforcement between 2010 and 2015. In an effort to keep Tehran content, for instance, South Korean officials essentially turned a blind eye to IBKNY and IBK banks’ dealings with Iran in 2011. As such, its current posture might very well be the sign of a major doctrinal shift in the conduct of its overall Middle East strategy and the diminished importance of Iran in it.

To begin with, Korean businesses’ short-lived encounters with their Iranian counterparts in the aftermath of the Iranian nuclear deal (formally known as JCPOA) have left a lasting negative impression on the suitability and possibility of doing business in and with Iran. South Korean executives found Iran’s highly corrupt and opaque market difficult to navigate. The absence of a clear-cut regulatory system, the dominance of Islamic Revolutionary Guard Corps (IRGC)-affiliated entities in all the key sectors, complex bureaucracy, and slow and highly politicized decision making processes collectively diminish investor confidence and thus turn a highly attractive market into an unattractive one for private entities. The Iranian market might look good from afar, but it is far from good.

More importantly, the market sectors that Seoul has traditionally sought to penetrate — like energy, infrastructure, and automotive — have all now been dominated by Chinese state owned enterprises which Korean firms simply cannot outcompete. Not only are Chinese companies more financially resourceful but they also enjoy the political backing of Beijing to win contracts. Moreover, once Beijing and Tehran sign their anticipated long term strategic pact, Tehran officially becomes a strategic ally of Beijing and a key locus in its Belt and Road Initiative (BRI). This, in turn, will prove detrimental to Seoul’s long-held desire of turning Iran into a regional hub for export of its goods and services into the wider Middle East and Central Asia. Put differently, it is hard to see how a U.S. ally can increase the strategic worth of a Chinese ally at a time when “sphere politics” is set for a strong comeback.

Taking into account South Korea’s own future strategic priorities, lastly, one can detect a clear realignment of Seoul’s ties toward the Arab states of the Gulf as well as Israel. In this regard, three issues stand out: energy security, defense exports, and technological cooperation.

Years of U.S.-orchestrated sanctions against Iran have, above other things, proved two points: first, that sanctions strengthen the regime by uniting its nucleus around the revolutionary ideal of anti-Americanism and, second, that Iran’s energy is replaceable. Even though Seoul, like many other energy dependent countries, would prefer a diversified portfolio of energy suppliers — with Iran being one of them — it has been able to replace Iranian oil with energy supplies from Iran’s southern neighbors. This is not to suggest that this has been an easy process; (re)adjustments are not supposed to be easy by their very nature. Rather, it proves that it is possible to find a substitute. In the case of Iran in particular, its rivalries and disagreements with its Arab neighbors have handsomely benefited energy dependent countries in that they essentially incentivize the GCC states to willingly substitute any loss of Iranian energy from the market. What is more, Seoul can take comfort in Iran’s acute need for customers once a degree of normality returns, knowing that it will have no problem purchasing Iranian energy once sanctions are lifted. After all, it is strategically more important for Iran to regain its lost market share than it is for South Korea to regain its lost share of Iranian oil and gas.

Given South Korea’s alliance with the United States, abundant energy resources and ability to replace the Iranian oil, developed financial markets, world class logistic and transport infrastructures, political stability, and more transparent, yet by no means perfect, regulatory systems, Seoul seems to have reoriented its regional policy from one that sought to strike a balance — however imperfect — between Iran and its southern neighbors to the one that clearly prioritizes the GCC states over and above Iran. Doing so, furthermore, has the added advantage of enabling South Korea to take concrete steps towards the realization of its recently articulated strategic objective of becoming an arms exporter to the region.

According to its Defense Reform 2020 Plan, Seoul has the ambition of becoming a major arm exporter, and thus the defense sector has become the newest frontier in South Korea’s export-led economic development strategy. This means that defense industries are now a tool for both national security and economic development, and hence the Foreign Ministry is mandated to develop a more hands-on approach for their promotion overseas. Not only so the GCC states have the financial muscle to invest in South Korea’s burgeoning defense industry, but their own drive for the establishment of homegrown defense industries provide ample room for cooperation and collaboration between the two sides. South Korea’s current cooperation with the UAE is a case in point.

With an eye on tapping into Israel’s vibrant tech sector, finally, Korean businesses have been quietly increasing their presence in the startup nation. Samsung, for example, has chosen Israel as the location of its world famous incubator, NEXT, with a clear mandate to work with local startups active in the fields of augmented/virtual reality, big data analysis, cloud computing, cybersecurity, deep learning, the Internet of Things, and natural language processing. Similarly, Lotte Group and various Korean VC firms, like L&S Venture Capital, DTNI, and Yozma Group, have been busy forging partnerships with, and investing in, Israeli startups working on nanotechnology, robotics, agriculture, and artificial intelligence.

Last year, in addition, the two sides signed a free trade agreement, which, in and of itself, is a clear sign of a major shift in the direction of Seoul’s regional diplomacy. In an effort to appeal to its Muslim partners, South Korea has been historically reluctant to add depth and breadth to its ties with Israel in spite of their common alliance with the United States, democratic political systems, and shared animosity toward North Korea as a strategic threat. With Saudi Arabia and the UAE joining Egypt and Jordan in establishing ties with Israel, albeit unofficially, Seoul no longer feels the need to exercise cautious in the development of its own relations with Tel Aviv.

The oddity of the recent turn of events could not be starker. Iran was one of the first Middle Eastern countries to establish diplomatic ties with the Republic of Korea in 1962. Since then, bilateral relations between the two were marked by a high degree of trust and cooperation on both the political and commercial fronts. With both belonging to the U.S.-led anti-communist camp, for instance, Tehran was one of South Korea’s staunch allies in the United Nations on all issues related to the Korean cause. Commercially, Korean contractors had close to 5 percent of all their businesses in Iran by the late 1970s. The Islamic Revolution, however, sucked the political air out of their relations and slowly turned their ties into a purely commercial affair void of any strategic depth. As a result, the two countries have been struggling to forge an organic commercial link that is immune to, and isolated from, the wider geopolitical developments in their vicinities. Given their opposing geostrategic orientations today, it is only fair to suggest that Tehran and Seoul have gone from friends with benefits to friends with detriments. Soon, they could very well stop being friends altogether.

Nima Khorrami is a research associate at the Arctic Institute.